How are renewables and AI reshaping power markets?

Posted: November 17, 2025

When it comes to renewable energy, there are some truths universally acknowledged: Renewable energy sources will continue to grow in both supply and demand—though not necessarily at the same rate; renewable energy is more variable and volatile than other, more fossil fuel-centric energy; and AI technology is drastically changing the scale of renewable energy generation and distribution.

All these truths are good news for energy traders, who can use the volatility of the market and advancements in technology to make money while helping to balance the grid.

Our Industrial Life

Get your bi-weekly newsletter sharing fresh perspectives on complicated issues, new technology, and open questions shaping our industrial world.

Deregulation and the wholesale electricity market

Historically, power utilities were vertically integrated: Generation, transmission, distribution and retail were all controlled by a single player. Deregulation—beginning in the eighties and nineties in the U.S. and Europe—allowed independent power producers to participate.[1] Enter the wholesale electricity market.

In a wholesale electricity market, electric utilities or load serving entities (LSEs) usually manage transmission and distribution but not generation. Under this model, independent energy suppliers need utilities or LSEs to manage the infrastructure of getting power to customers, and utilities or LSEs need the electricity generated by suppliers. Though different regions have different structures in place, most deregulated markets need some kind of system that oversees the market and manages grid reliability. In the U.S., regional transmission organizations (RTOs) and independent system operators (ISOs) often serve this role.

RTOs and ISOs in the U.S. ultimately determine and manage wholesale prices for three different branches of the power market: energy markets, capacity markets and ancillary services markets. Capacity markets basically pay suppliers to be ready to produce power when it’s needed, while ancillary services markets handle services outside the primary electricity market required to keep the grid balanced, such as demand response and storage. Energy markets are where the actual buying and selling of electricity happens. This is where electricity generators offer to sell their electricity for a bid price and utilities or LSEs bid to buy that electricity to give to their customers. RTOs generally dispatch generation by the lowest cost to allow the market to meet demand while keeping prices low.[2]

Due to the growing complexity of wholesale electricity markets, energy traders are increasingly acting as facilitators between suppliers and buyers in this system.

What is energy trading and how do renewables fit in?

Energy trading looks different depending on a number of different factors, but in a nutshell, traders predict how much electricity will be needed at a particular time. They buy that electricity (at the lowest price they can), and then sell it (at the highest price they can).

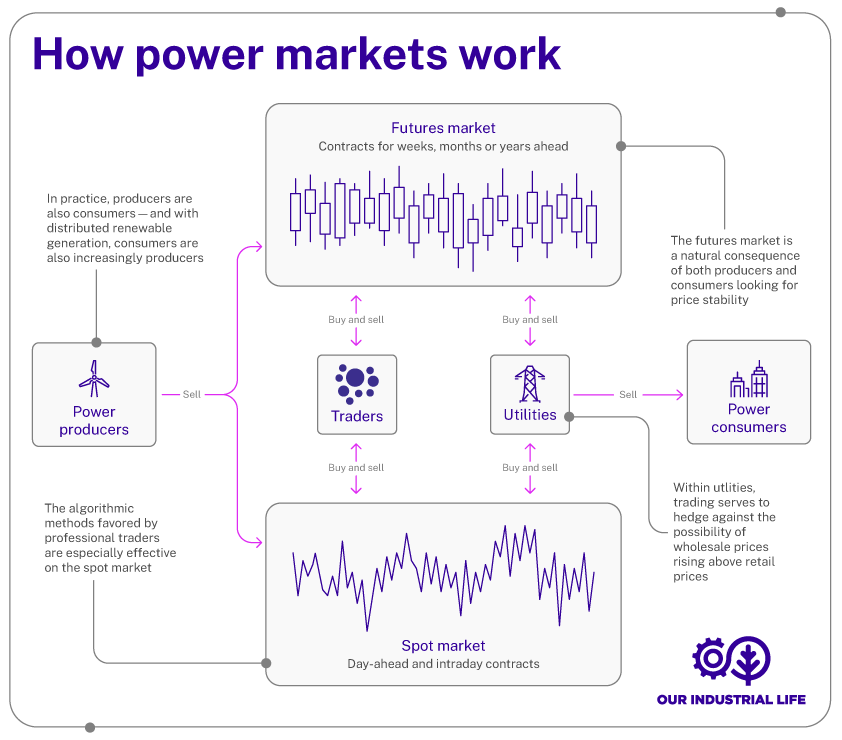

Energy trading happens in two main buckets: the futures market, which includes trades for electricity to be delivered at a future date, weeks or months or years ahead; and the spot market, which includes day-ahead and intraday trades up to minutes before delivery. Market exchanges—like EPEX Spot in the U.K. and California’s CAISO in the U.S.—ultimately make the transaction between supply and demand, setting the clearing price for contracts and making sure the electricity gets to where it needs to go.[3]

The addition of renewable energy to the grid has introduced a little more complexity into this system, as even more power producers enter the market. The rise of virtual power plants (VPPs), which aggregate different distributed resources such as rooftop solar panels and smart thermostats, and individual prosumers, who both generate and consume electricity, means that there is an even greater variety of power sources that require balancing.

Now, as electricity demand from sources such as EVs, data centers and industrial production increases, the power marketplace becomes even more complex and dynamic.[4] What used to be a relatively linear supply chain from fuel to consumption is no longer so simple. Unpredictable weather, shifting demand patterns and a wider, more varied ecosystem of sources add complexity and volatility.

As renewables scale, the nature of energy trading becomes more challenging, but also potentially more profitable. And ideally, trading also helps bring stability to the grid. Because renewables are intermittent and decentralized, balancing and dispatching become more delicate. Skilled traders can help mitigate bottlenecks, smooth volatility and keep energy generation competitive—ultimately hopefully saving consumers money and keeping electricity flowing to where it needs to go.[5]

How real-time data, AI and algorithmic trading are changing the energy trading game

The volatility of renewable energy sources demands near-real-time energy trading. Markets once dominated by day-ahead auctions now increasingly focus on short-term trading, up to minutes before the energy is delivered.[6] This is why real-time data has become an essential tool for traders. Real-time grid conditions, weather forecasts and asset analytics are just a few of the kinds of information traders need to stay ahead.

Perhaps the most significant transformation in the energy trading domain is the integration of advanced analytics, AI and machine learning models and algorithmic trading strategies. Traders are increasingly using AI technology for forecasting weather, load, generation and congestion more accurately.

Algorithmic trading, in which automated bots respond to signals, enables traders to capitalize on split-second fluctuations. Most algorithms traders use are rule-based, in which the trader sets the parameters for how and when energy is to be traded, though traders are increasingly using more advanced algorithms that incorporate AI and machine learning.[7]

How the “Silicon Valley of energy trading” and Wall Street turned renewable energy into profit

Denmark has been called the “Silicon Valley of energy trading” for its intense trading culture. As Rachel Millard writes in The Financial Times, “A mix of high potential profits, intellectual challenge and a role in the transition to a green economy have drawn dozens of smart young trading entrepreneurs to set up ventures in both Aarhus and Aalborg, just over 100km away.”

Algorithms have become an essential part of the trading culture at companies like InCommodities in Denmark. One study by the Netherlands’ Authority for Consumers and Markets (ACM) put it this way: “The energy transition is a development that drives the use of algorithms even further. The generation of renewable energy is less predictable, as a result of which the need for traders to manage their positions at the last minute increases.”

However, the deployment of algorithmic trading has also prompted some questions and concerns about inadvertent market manipulation. The ACM study pointed out that when two algorithms have a “robot battle,” the rapid speed of trading could produce “false or misleading signals” in the market. The EU Agency for the Cooperation of Energy Regulators (ACER) agrees that the speed of algorithmic trading presents challenges for regulators, though the rules for algorithmic trading on wholesale markets have recently tightened and are being enforced by the ACM.[8]

What is the future of energy trading?

Energy trading is, in many ways, the art and science of foretelling how electrons and fuels will flow under uncertain circumstances. The rise of renewables, increased connectivity of grids, regulatory shifts and growing electrification have transformed what was once a relatively static sector into one of the most dynamic and data-intensive markets in finance.

One adaptation that traders will have to make over the coming years is around the rollout of battery storage, which is poised to improve grid stability by providing short-term flexibility for periods of 1-8 continuous hours. And as costs to make batteries decline and their storage capacity increases, battery storage will become even more prevalent in the marketplace.

Indeed, battery capacity itself might well be incorporated into power markets, with traders swapping storage contracts just as they do power contracts.

As storage grows and the market becomes more competitive, prices should—in theory, at least—fluctuate less. But that won't make AI tools and automated trading less important: If anything, the opposite will be true. Like so many hedge funds and banks before them, traders will likely come to depend more and more on high-frequency trading bots that can make a profit on even the most minute and momentary changes in price.

[1] https://www.pbs.org/wgbh/pages/frontline/shows/blackout/regulation/timeline.html

[2] https://www.rff.org/publications/explainers/us-electricity-markets-101/

[3] https://www.ferc.gov/media/energy-primer-handbook-energy-market-basics

[4] https://www.iea.org/reports/global-energy-review-2025/electricity

[5] https://www.ft.com/content/ab992f40-c6c2-45be-aa82-c6bf5b38df29

[6] https://www.mckinsey.com/industries/electric-power-and-natural-gas/our-insights/unlocking-value-from-power-and-natural-gas-trading-in-north-america?

[7] https://www.acm.nl/en/publications/acm-use-algorithmic-trading-energy-market-has-increased-strongly

[8] https://www.acm.nl/en/publications/acm-use-algorithmic-trading-energy-market-has-increased-strongly