Coming soon: Transformative next-gen battery chemistries

Posted: May 16, 2025

Toward the end of April, Gao Huan, the CTO of the Chinese battery giant CATL stood on stage inside a converted Shanghai warehouse and unveiled the company’s latest breakthroughs.

Headlines were grabbed by the astonishing performance of its next-generation lithium-ion batteries (1,500 km of range! 500 km of charge in five minutes!). Still, arguably the most significant announcement was around the imminent arrival of its sodium-ion battery.

When it comes to rechargeable batteries, lithium-ion has been pretty much the only chemistry in town since the 1990s. In that time, mines across the world have opened to supply the lithium, nickel, cobalt, manganese and other metals these batteries require, and—as further evidenced by the CATL event—China has gradually tightened its hold on both the supply chains and expertise behind lithium-ion.

Our Industrial Life

Get your bi-weekly newsletter sharing fresh perspectives on complicated issues, new technology, and open questions shaping our industrial world.

But it seems that new battery chemistries are like London buses: you wait 30 years for one to come along, and then two arrive at once. Not far behind sodium-ion technology, lithium-sulfur chemistry is emerging as a viable alternative to lithium-ion.

The emergence of these two new chemistries represents a major development in the world of batteries, and as the demand profile for battery metals evolves, it could also have significant impacts on existing supply chains, the fortunes of miners, and even the health of national economies.

Abbreviations: Lithium-ion --> Li-ion | Sodium-ion --> Na-ion | Lithium-sulfur --> Li-S

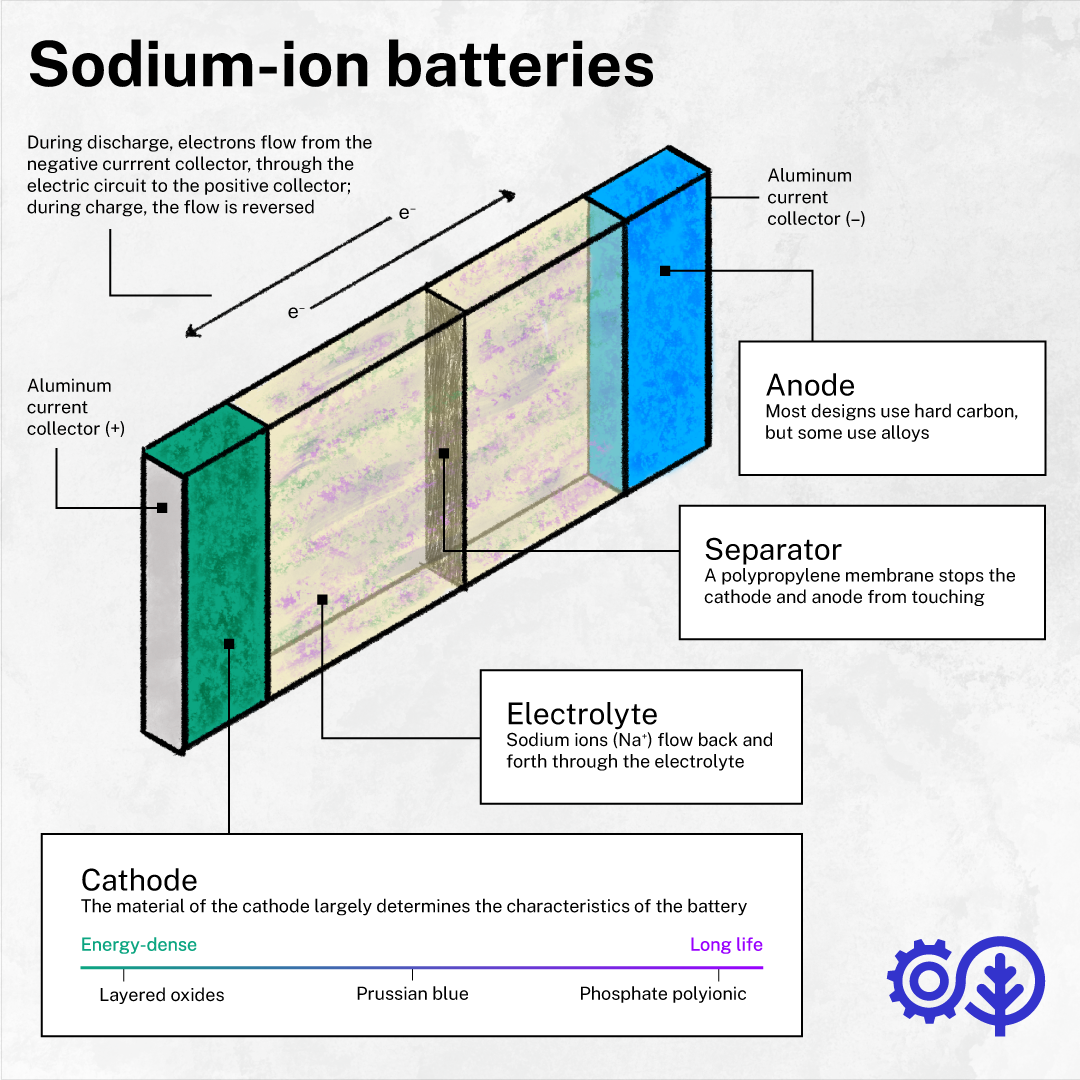

Sodium-ion: abundant and great at low temperatures—but not energy-dense

As one of the most abundant elements on Earth and present in common salt, sodium is much easier to source than lithium. That translates to potentially much lower costs—up to 100 times lower than lithium carbonate, according to the Volta Foundation’s latest Battery Report.

And compared to Li-ion, Na-ion batteries have several advantages, including longer lifespans, the capacity to rapidly charge and discharge them, and the ability to safely discharge them to 0% (making them easier to transport). Perhaps the most significant of their advantages, however, is their capacity to hold their charge in extremely low temperatures—something Li-ion batteries are notoriously bad at.

The main downside to Na-ion designs remains their comparatively low energy density, a drawback that makes them less useful for applications where weight is a significant consideration (e.g. drones). A recent study by academics at Stanford concluded that the limitations of current Na-ion technology means that “possible lower materials prices aside, the cost per unit of energy stored remains higher for sodium-ion batteries.”

The study, which appeared in Nature, predicts that Na-ion batteries will reach price parity with the lower-grade LFP variety of Li-ion batteries by 2030. In an interview with Reuters, meanwhile, Zeng Yuqun, the CEO of CATL, said he believes Na-ion batteries could replace up to half the market of lower-grade Li-ion batteries.

And CATL by no means has a monopoly on Na-ion tech—there are dozens of other Chinese companies working on chemistries. Outside of China, one company to watch is Natron Energy. The outfit claims its batteries, which are designed and manufactured in the United States, “outperform lithium-ion batteries in power density and recharging speed, require zero lithium, cobalt, copper, nickel, and are non-flammable.”

Lithium-sulfur: lightweight and energy-dense—but unproven at scale

The technology behind Li-S batteries is, in theory at least, even more promising than that of Na-ion thanks to its very high theoretical energy density (five times that of Li-ion).

Li-S chemistry, however, is less well developed than Na-ion, and the cycle life of the batteries has long been hampered by a technical complication called the “shuttle effect,” which sees a reaction in the electrolyte gradually lead to the deterioration of the anode and cathode.

As such, there are far fewer major players—just 10, according to Volta’s Battery Report. China’s dominance is also less pronounced in Li-S. The two companies potentially closest to commercialization are in the U.S.

Texas-based Zeta Energy signed an agreement in December 2024 with auto conglomerate Stellantis to develop a Li-S battery for use in EVs by 2030. Lyten, which has also received investment from Stellantis, claims to have tackled the “shuttle effect” through its proprietary 3D graphene material. In a perfect illustration of a potential use case of lightweight Li-S batteries, in September 2024 Lyten’s technology was chosen for demonstration aboard the International Space Station.

What effect will these chemistries have on supply chains?

Given both Na-ion and Li-S chemistries are only just reaching commercialization, the immediate impacts on supply chains and metal demands won’t be significant.

But changes could be felt quicker than you might think.

The manufacturing processes of Li-S and Na-ion batteries are both very similar to those of Li-ion batteries. Lyten emphasized this point when it acquired one of Northvolt’s Li-ion manufacturing facilities.

“Lithium-sulfur is a highly manufacturable battery that can be produced on standard lithium-ion equipment used throughout the world today,” said Celina Mikolajczak, Lyten’s Chief Battery Technology Officer, in a press release. “We intend to use this advantage to continue to opportunistically expand Lithium-Sulfur production through the acquisition of lithium-ion assets,"

Because the manufacturing process is so similar, existing facilities could quickly change the type of battery they produce, which could lead to rapid changes in demand for certain metals.

Three metals that are not required by either of the new chemistries look particularly vulnerable: cobalt, manganese and nickel. That could be unwelcome for major producers of those metals: respectively, the Democratic Republic of Congo, South Africa and Indonesia. Another key component of lithium-ion batteries, graphite —which is produced primarily in China— also isn't required in either Na-ion or Li-S batteries.

Although lithium isn't required for Na-ion batteries, the prevalence of Li-ion batteries, plus the growing production of Li-S batteries, means that big producers of that metal—Australia, Chile, and China—should be able to rely on demand for the foreseeable future.

And what about sodium and sulfur, the headline metals in these new chemistries? Both are, relative to the other metals mentioned, extremely abundant. Sodium for use in batteries can be extracted from common salt, a mineral that is widely produced across the globe. Sulfur, meanwhile, can be mined directly but is most immediately available as a byproduct of oil and gas processing.

The supply chains of so-called critical minerals have been under the spotlight of late, but these emerging battery chemistries demonstrate that precisely which minerals are considered critical is not set in stone.