Power Industry Trends in the Middle East and North Africa (MENA) Region

Please enjoy the informative blog below. Learn how AVEVA can help you achieve operational excellence and lower your carbon footprint by visiting our Power Industry website.

The power industry sector in the MENA region represents a major source of investments opportunities, averaging approximately $30 billion of capital expenditure annually. The COVID-19 pandemic dealt a significant blow to all countries in the region. The lockdowns led to a decline in power demand in the commercial and industrial sectors, while the demand of electricity in the residential sector picked up as more people were forced to work from home to curb the spread of the virus. Looking at the spending side, power sector contract awards in the first half of 2020 amounted to $5.9 billion, a decrease of almost 10% over the same period in 2019. As we enter 2021, there is optimism in the region for the ease of the lockdowns due to the advent of the virus vaccine. This combined with population growth and an industrial and economic expansion will lead to higher electricity demand and a bright future for the electricity sector in the region. However, this marked optimism must also consider considerable challenges in many fronts.

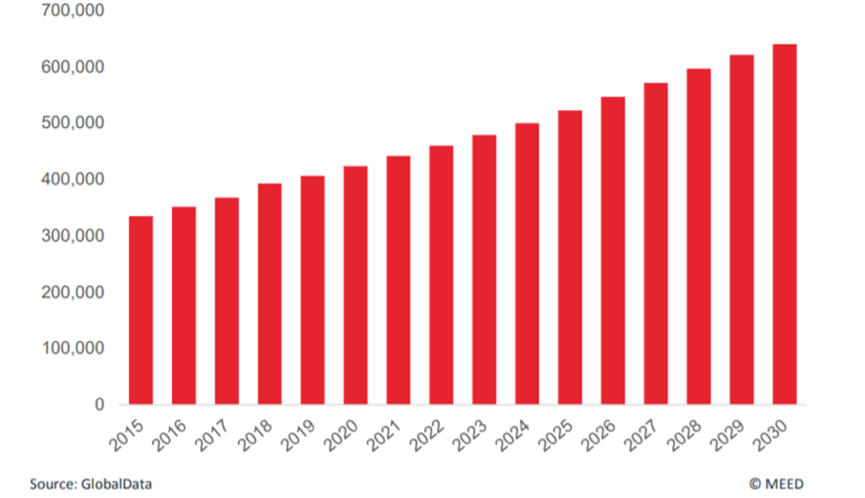

40% More Generating Capacity Needed by 2030

Population growth as well as increasing electricity demand due to the expected expansion of the downstream oil and petrochemical sectors will lead to robust growth of MENA’s generating capacity. According to MEED, the installed generating capacity in 2019 was 406 GW in 2019, and it needs to increase by 40% to meet expected demand in the year 2030.

According to GlobalData in 2019, Saudi Arabia and Iran lead the region in installed capacity with over 80GW each. Egypt, Iraq and the UAE were the other notable countries in the MENA region with installed capacities higher than 30 GW each. These same countries will also lead the investment in generation infrastructure and generation capacity in the future.

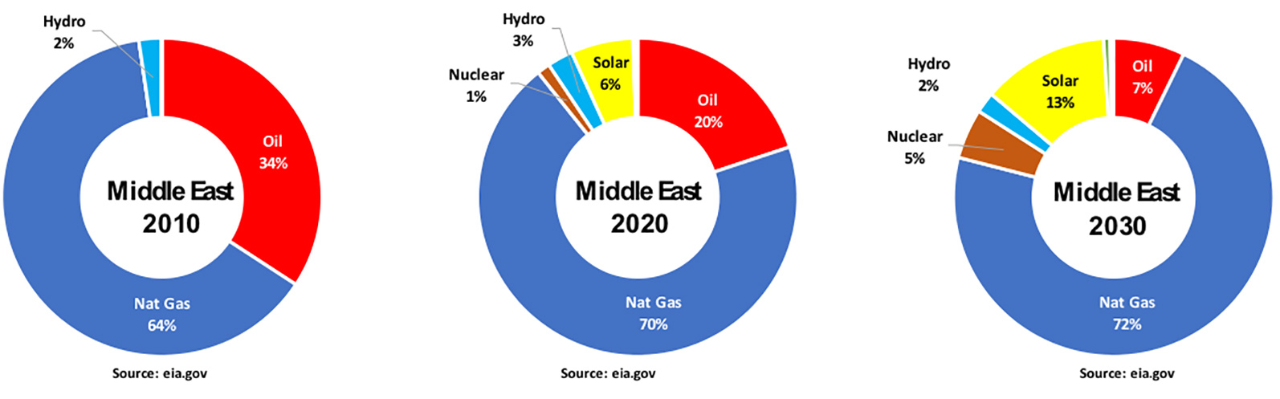

Fuel Mix: Moving from Oil to Natural Gas

The region will continue the trend of moving away from oil-based to natural gas- based electricity generation by 2030. Making use of the large natural gas reserves, Saudi Arabia and Kuwait are leading the effort of converting to more efficient and less polluting gas turbines to replace oil-fired turbines to produce their electricity. However, other countries in the region do not have enough domestic gas supply to satisfy their electricity needs. Despite the expected growth in gas-fired generating capacity, MENA countries are also looking at renewables, nuclear and even coal power to boost generation security, when gas is not affordable or easily available.

Renewable Generation Plays a Role

Most countries in the MENA region are building or planning new solar and wind projects, and solar is expected to reach 13% of annual generation by 2030, more than doubling 2020 generation. The drivers for renewable are very similar to other world regions: improved technology, falling costs and public preference for greener electricity.

Dubai has set a 75% clean energy target by 2050, the most ambitious in the region. Most countries in the region have set renewables targets that range from 13 to 52% of installed capacity by 2030. As of 2020, MEED reports 28GW of renewable capacity in the region. The planned new generation capacity is 98 GW, with an additional 39 GW expected to be added to the planning stream by 2025.

The COVID-19 restrictions on travel and the movement of people undoubtedly delayed the schedules and increased the cost of implementing renewable energy projects in the region. On the other hand, there is a strong political will by governments to protect their citizens and help their economies through substantial stimulus packages, including lower interest rates and greener infrastructure projects. Also, renewable energy production is increasingly seen as resilient to fuel supply interruptions. These factors will weigh favorably in the future of renewable energy projects going forward.

But Renewable Generation Faces Challenges

While wind and solar energy will play a role in the decarbonization process, we still need to solve a major technological change, and that is dispatchability. While sun and wind are available everywhere, they are not available on demand. They need some sort of energy storage to be dispatchable. Therefore, energy storage is considered the holy grail needed to achieve maximum renewable energy penetration and decarbonization.

As the penetration of renewable energy increases, battery storage is needed to mitigate the rapid ramp rates required to meet shortfalls in renewable generation, particularly the sharp evening peak when the sun goes down. Also, concentrated solar power (CSP) with thermal storage can be used for this purpose.

On the regulatory front, merging renewable energy into power grids requires policy adjustments and new regulations. This includes ensuring grid flexibility and stability, integrating new technologies such as battery storage and electric vehicles, and establishing commercially attractive business models.

The cost of renewable energy has continued to come down due to the efficiency of the global supply chain prior to the pandemic. However, COVID-19 exposed the fragility of the supply chain, leading many countries to accelerate their move to local suppliers to secure supply, and increase local employment. Saudi Arabia aims to reach 70% local content from construction to operation and maintenance in their renewable projects. Prolonged low oil prices will complicate the nationalization of the supply chain, and it could lead to postponement or cancellation of some renewable projects.

Smart Grids and Transmission Investments

The ambitious sustainability targets implemented by governments in MENA are pushing utilities and power transmission companies to invest in smart grid technology and infrastructure. In its recent outlook for 2020 through 2024, the Arab Petroleum Investments Corporation (APICORP) highlighted the expected investment increase in power and distribution projects in several countries, driven by the rise of renewable generation and the increased focus on boosting regional interconnectivity. New technologies featuring cloud based, artificial intelligence and machine learning are expected to play a major role in greener, smarter electricity grid for the MENA region. To support this digitalization effort, many countries, Saudi Arabia for example, have invested billions of dollars to deploy 10 million smart meters across the region.

Nuclear Energy Option

The use of nuclear power for electricity generation is seen favorably by the citizens of the Arab world. A public survey in the UAE in 2013 found over 82% favorability to develop nuclear technology. Besides adding renewable generation, utilities are also planning projects to develop nuclear power plants to diversify fuel sources and boost energy security. The United Arab Emirates welcomed the first nuclear plant in the Arab world in 2020. Egypt has started work in its first nuclear power project at El-Dabaa, and Saudi Arabia is expected to tender a 2.8 GW nuclear power project to international vendors in the near future.

Privatization and Financing

There is a movement to a privatization of giant state-owned power utilities. In order to raise much needed capital, governments are selling assets as well as separating generation, transmission and distribution responsibilities. There is also an expectation that privatization will lead to increase in reliability, as well as capital and operational costs efficiencies in the long run.

COVID-19 created uncertainties around government spending, causing a temporary pause of the privatization efforts. While delayed, the goal of privatization remains high in different government agendas. Low oil prices and higher spending from the required stimulus packages to combat the effect of the pandemic will provide added urgency for governments to continue their privatization.

The region is also experiencing a renewed interest in privately developed utility projects in order to spread the capital cost of building new capacity over a longer period.

Still a bright future

There remain many challenges for the power industry sector in the MENA region. However, a growing population, fuel mix diversification, new technologies and business models still point to a brighter future. AVEVA’s leading industrial software, together with OSIsoft’s world-class operational data management, empowers the people behind the power industry to engineer smarter, operate better and drive sustainable efficiency. Visit our website for more information.

Related Blog Posts

Stay in the know: Keep up to date on the latest happenings around the industry.